-

Center for Global Commons

Launch of CGC-NBS; an Industry-Academia Collaboration Platform for the “Nature on the Balance Sheet” initiative

Center for Global Commons

As the collapse of natural systems emerges as a major threat to businesses, economies, and societies—through extreme weather events, natural disasters, supply chain disruptions, and food security challenges— “Nature Positive” has emerged as the global agenda alongside with Carbon Neutral”. Although Nature Positive initiatives are gaining traction globally, their progress remains fragmented and slow, failing to meaningfully influence corporate and investment decision-making.

Time is running out. Many aspects of natural systems, once lost, cannot be restored. To halt and reverse nature loss at its root, markets must recognize the true value of natural capital—long regarded as “infinite” and “free”—and embed this value into every economic decision.

Despite the difficulty of valuing natural capital and growing backlash against sustainability agendas, industries are beginning to acknowledge that nature loss undermines their business foundations. Regulators are recognizing its devastating impact on economies and societies. Furthermore, more entrepreneurs and investors are actively pursuing and realizing value from investments in nature. What is now urgently needed is to ensure this recognition of nature’s value moves beyond isolated projects and niche markets, becoming part of mainstream market infrastructure.

The University of Tokyo’s Center for Global Commons (CGC) has partnered with likeminded international organizations to form the Mountains Group (see below) and launch the “Nature on the Balance Sheet” Initiative. This initiative brings together experts in natural capital valuation, its market recognition, and supporting market infrastructure to develop a pioneering roadmap for embedding natural capital into economic decision-making—and ultimately, into corporate balance sheets. The initiative aims to catalyze new international rulemaking in this field and drive reform of the current economic system. Under this initiative, three key steps for recognizing natural capital in markets and five reform stages for market infrastructure have been outlined (see below). The initiative also includes joint proof of concept projects with participating companies to verify the proposed roadmap leads to changes in corporate decision-making and value creation derived from natural capital.

To support this effort, the Center for Global Commons at the University of Tokyo has launched the CGC-NBS Sponsorship Program, a platform for industry-academia collaboration. While Europe has traditionally led in international rulemaking, Japan and Asia—regions rich in natural capital and long reliant on its use—should have a strong voice in shaping global standards for natural capital valuation and integration into decision-making. Japanese corporate sector has demonstrated its leadership in transition to nature positive economy, shown by the fact that Japan has the highest signatories as early adopter for TNFD. Through the participation of Japanese companies in the rulemaking efforts led by the Nature on the Balance Sheet initiative, we aim to ensure that the voices of Japan and Asia are reflected in the transition to a Nature Positive economy.

Participating Sponsors and Expected Contributions

Four companies have joined this initiative as corporate sponsors. Each maintains deep ties to natural capital through their business activities and has committed to supporting the project’s objectives:

- Oji Holdings Corporation: With a long-standing history of value creation rooted in forest resources, including paper and pulp, Oji will participate in testing natural capital accounting approaches.

- Sumitomo Forestry Co., Ltd.: With a global business spanning forest management, timber products, and wooden architecture, Sumitomo Forestry will contribute expertise in evaluating shared value provided by forests and in sustainable forestry and timber construction.

- Ajinomoto Co., Inc.: As a global food industry leader, Ajinomoto will help develop valuation methods for agricultural ecosystems and raw material sourcing.

- MS&AD Insurance Group Holdings, Inc.: As a major player in insurance and finance, MS&AD will participate in analyzing how nature-related risks and biodiversity loss impact the insurance and financial sectors.

With these sponsors, the University of Tokyo CGC is better positioned to incorporate Japanese and Asian perspectives in international rulemaking in this area. Sponsors will also benefit from real-time insights into evolving global trends, supporting their strategy development. Corporate participation from Japan sends a strong signal—both domestically and internationally—about the private sector’s pivotal role in the Nature Positive transition, serving as a model for collaboration among governments, academia, and businesses to tackle global challenges.

[For reference]

Scientific Background

Earth system scientists, led by Johan Rockström, developed the “Planetary Boundaries” framework to illustrate the relationship between ecological thresholds and our economic systems. Of the nine critical systems identified, six have already exceeded their safe operating limits. Today’s economic system is destabilizing the very Earth systems, the foundation of our civilization, with nature loss—alongside global warming—threatening humanity’s survival.

This crisis stems from the unchecked exploitation of natural capital, long assumed to be infinite and free. As a result, ecosystems, water, and soil—key pillars of Earth’s stability—are now under severe strain. The goal of the Nature on the Balance Sheet initiative is to embed the true value of natural capital into economic decision-making, creating a Nature Positive economy that puts economic system in harmony with natural systems.

5-Step Roadmap for Integrating Nature into Economic Decision-Making

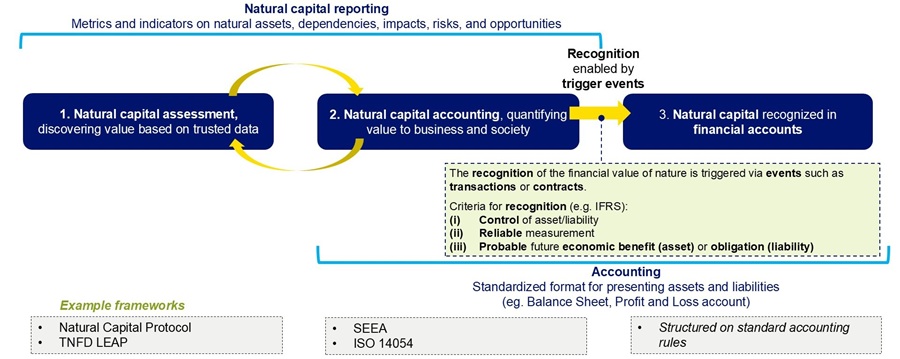

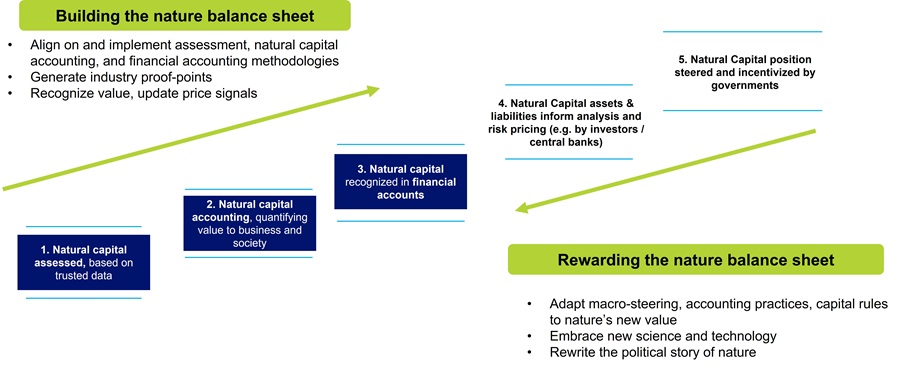

The Mountains Group has developed a five-stage roadmap for embedding natural capital into corporate balance sheets. This roadmap guides companies in treating nature-related risks as core business risks and furthermore equips them to turn nature into a source of investment and growth opportunity. This journey involves three key steps toward financial valuation, with particular emphasis on the critical transition from Step 2 to Step 3.

- Discover: Identify the value of natural capital based on reliable data. Ongoing, high-quality assessments reveal how businesses impact and depend on nature. This step begins by connecting scientific knowledge with on-the-ground data to visualize the current state and value of natural capital.

- Quantify: Measure the value of nature to business and society. Using natural capital accounting methods, both stocks (e.g., forests, water) and ecosystem services (flows) are measured. This enables monetary valuation of nature’s degradation or enhancement and facilitates its integration into decision-making.

- Recognize: Reflect the value of natural capital in financial accounting. This involves recognizing nature’s value in corporate financial statements and creating integrated accounts that combine natural and financial capital. The value of ecosystems and biodiversity—traditionally unaccounted for—can be incorporated in the balance sheet, influencing enterprise value and performance evaluation.

These three steps help natural capital owners and users recognize its financial value and form the basis for markets that reflect this value in accounting systems. However, beyond these steps, public institutions such as governments and central banks must provide incentives to encourage sound natural capital management.

- Market Pricing: Evaluate nature-related assets and liabilities through the market. Investors, insurers, and financial institutions begin pricing natural capital into asset and risk assessments. This could lead to higher valuations for companies sustainably managing nature and increased capital costs for biodiversity-intensive activities, thus redirecting capital flows toward conservation and restoration.

- Codification & Promotion: Institutionalize and scale natural capital valuation. Governments and central banks integrate natural capital into fiscal, monetary, and regulatory policies. For instance, introducing natural capital accounts into national statistics or requiring financial disclosures of nature-related risks. This formalizes and standardizes rules under which companies and investors operate globally.

These five steps offer a comprehensive pathway to “put nature on the balance sheet.” The roadmap is designed for testing and implementation by land stewards, companies, financial institutions, and policymakers, with its broad adoption expected to serve as a tipping point for transitioning to true natural capital economy.

The “Mountains Group” Collaboration

The Nature on the Balance Sheet initiative is jointly led by a coalition of four organizations: Capitals Coalition, Systemiq, The Landbanking Group, and the University of Tokyo CGC (Center for Global Commons) collectively known as the “Mountains Group.” This partnership is developing an innovative framework for valuing natural capital as an economic asset.

Capitals Coalition leads global efforts to make value visible, offering methodological expertise such as the Natural Capital Protocol. Systemiq is a systems-change company driving strategic design across policy and finance. The Landbanking Group is a startup creating financial infrastructure that uses natural capital as collateral, developing technology platforms for valuation and trading. The University of Tokyo CGC contributes scientific insight and implementation capacity, supported by an academic and research network across Asia, grounded in its mission to protect global commons.

This “radical collaboration” across academia, industry, finance, and policymakers aims to rapidly and broadly integrate natural capital into the economic system at a scale never seen before.

Contact:

The University of Tokyo Center for Global Commons

Yuya Kajikawa, Keiya Masuno, Mieko Iizuka

e-mail:info.cgc[at]ifi.u-tokyo.ac.jp

*[at]→@